If you’re still tracking your business finances in Excel or Google Sheets, it’s time to move to a smarter system. Zoho Books is a cloud-based accounting platform built for small business owners who want an affordable, easy-to-use way to manage invoices, expenses, payments, reporting, and more all in one place.

I break down the key business processes you need to get started. This guide combines all 10 videos in the series into one step-by-step resource so you can go from zero to confident in less than an afternoon.

Watch to See if Zoho Books is Right for You

1. What Is Zoho Books (And Why You Should Ditch Spreadsheets)

Zoho Books is part of the Zoho business software suite, but it can be used on its own. It handles:

Invoicing – Create professional invoices and send them directly to clients.

Expense tracking – Log and categorize business expenses in seconds.

Payments – Accept online payments via credit card, bank transfer, or payment apps.

Reporting – Generate profit and loss statements, cash flow reports, and tax summaries.

Automation – Set recurring invoices, payment reminders, and more.

Why it’s better than spreadsheets:

No more manual formulas or copy-paste errors.

Your data updates in real time.

Built-in payment and tax tools keep you compliant and paid faster.

Accessible anywhere via web or mobile app.

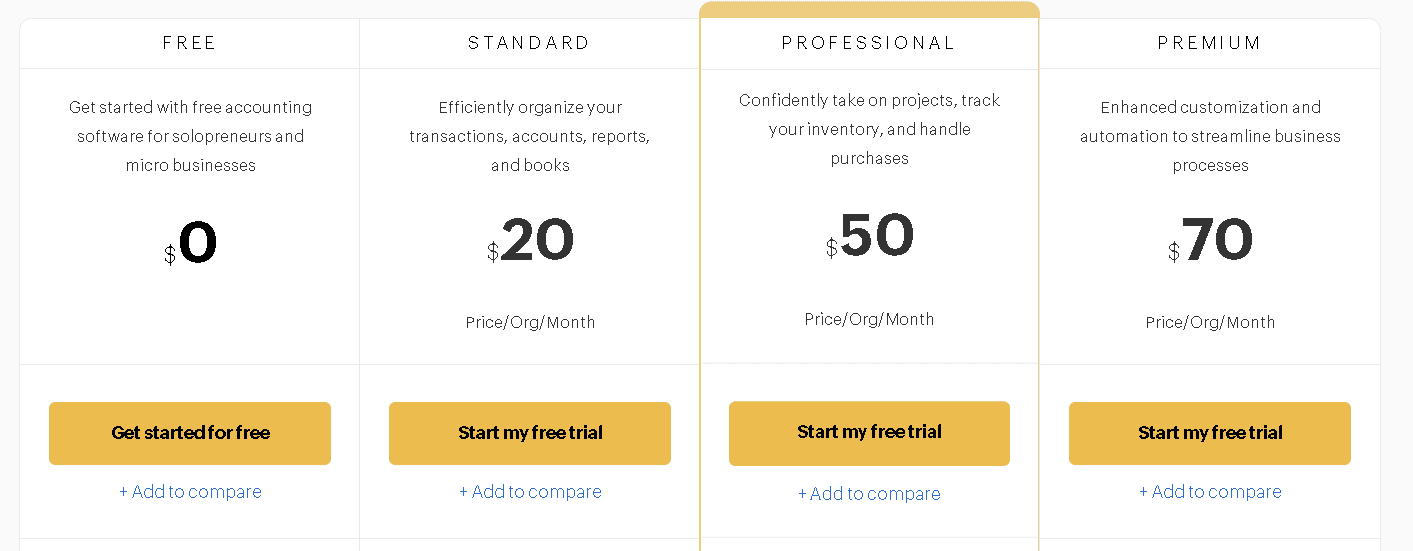

How Much Does Zoho Books Cost?

Zoho Books has many options to get started, including a FREE plan to help get your business off the ground. They make running organized and clean financial processes a no-brainer to implement in your business. You can visit this link for a full pricing breakdown, or read below for a quick breakdown on each of the plans to help you determine which one's right for you:

Free Plan

- Price: $0 (eligible if your annual revenue is under $50K)

- Annual Invoice Limit: Up to 1,000

- Expense Entries: Up to 1,000

- Users: 1 user and 1 accountant access

- Who is this for: A great option for solo entrepreneurs and micro-businesses

- Price: $20/month

- Annual Invoice Limit: Up to 5,000

- Expense Entries: Up to 5,000

- Users: 3 users

- Expanded Functionality: Time Tracking and Expanded Bank Workflows

- Price: $50/month

- Annual Invoice Limit: Up to 10,000

- Expense Entries: Up to 10,000

- Users: 5 users

- Expanded Functionality: Vendor bills, recurring transactions, vendor credits, multi-currency support, and expanded user access controls

- Price: $70/month

- Annual Invoice Limit: Up to 25,000

- Expense Entries: Up to 25,000

- Users: 10 users

- Expanded Functionality: Purchase orders, sales orders, inventory tracking

2. Set Up Your Zoho Books Account in Under a Minute

Getting started is simple:

Go to zoho.com/books and click Start My Free Trial.

Enter your company name, email, phone number, and create a password.

Choose your country and state.

Click Create Account.

Follow the remaining prompts and you're ready to go.

3. How to Add Customers and Vendors

Before you can send invoices or record expenses, you need to set up your contacts.

Go to Sales > Customers > +New (on the top right).

Choose Business or Individual.

Fill in their contact and billing details.

Save your changes.

4. How to Send Your First Invoice

Go to Sales > Invoices > + New.

Select your customer.

Select the date your invoice will be sent and the invoice terms

Add a subject and detail your products or services in the Item Table.

Indicate an online payment option if desired (set up below)

Click Save and Send

Customize with your logo and brand colors.

Preview the invoice, then click Send.

Clients will receive a professional PDF with a payment link if you’ve set up a payment gateway.

5. Track Your Expenses Like a Pro

Say goodbye to the shoebox of receipts. To log an expense:

Go to Purchases > Expenses > + New Expense.

Enter the expense account, amount, paid through (payment account), and vendor.

You can add a customer name and indicate it as billable with a markup, if you would like to charge it back to a customer.

Upload a receipt.

Click Save.

Pro tip: Mark expenses as billable if you plan to pass them on to a client.

6. Set Up Payment Gateways to Get Paid Online

Connecting a payment gateway makes it easier for clients to pay you—and they’ll pay faster. Supported gateways include:

Stripe

PayPal

Zoho Payments

And more

To set up:

Go to Settings > Online Payments > Customer Payments

Choose your provider and follow the setup instructions.

7. Connect Your Bank Account for Automatic Imports

Go to Banking > Connect Bank or Credit Card.

Search for your bank.

Log in securely and select your account.

Zoho Books will import your recent transactions automatically.

No more manual entry. You can match transactions to invoices and expenses in seconds.

8. Track Mileage and Travel Expenses

Mileage tracking can be a major tax deduction for service-based businesses. To log mileage:

In the Zoho Books mobile app, go to Mileage.

Choose Manual Entry or GPS Tracking.

Enter the trip date, starting point, destination, and purpose.

Save and categorize it.

9. Reconcile Your Bank Account Without the Stress

Reconciliation ensures your Zoho Books records match your bank statement.

Go to Banking > Select your account > Reconcile.

Match imported transactions to invoices or expenses.

Add any missing transactions.

Click Reconcile when all amounts match.

10. Run Reports Like a Pro

Reports help you understand your business health at a glance. Popular reports include:

Profit & Loss – Shows your income, expenses, and profit.

Cash Flow – Tracks money in and out.

Balance Sheet – A snapshot of assets, liabilities, and equity.

Access reports via Reports in the sidebar, choose a date range, and export to PDF, XLS, or CSV.

Pro Tip: Find the reports important for your business to review on a regular basis. You can schedule them to automatically arrive in your inbox weekly, monthly, quarterly, or annually.

Bottom Line

Zoho Books is designed to grow with you. Whether you’re a solo entrepreneur or managing a small team, it gives you the tools to:

Keep finances organized

Get paid faster

Stay tax-ready

Make decisions based on real data

Start simple with invoicing and expense tracking, then explore automation, advanced reporting, and integrations as your business scales.

Ready to get started, but want some help? Or maybe you're migrating from another financial suite and want to ensure its done accurately. Schedule a call and we can get you started!